student loan debt relief tax credit virginia

Debt collection in Virginia. Review the credits below to see what you may be able to deduct from the tax you owe.

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

The American Opportunity Tax Credit is available for first-time college students during their first four years of higher education.

. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. That number looks to rise in a post-pandemic world as consumer spending begins to roar back. Use these tips to get the most value from your refund check.

If a student has 18000 in loans with a standard 10-year repayment and 6 interest how much will that students payments be each month. CuraDebt is a company that provides debt relief from Hollywood Florida. Employers can contribute toward employees student loan debt for temporary tax relief.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Biden just wiped out student debt for all remaining student defrauded by for-profit Corinthian Colleges. On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov.

See Tax Bulletin 22-1 for more information. It was founded in 2000 and is an active part of the American Fair Credit Council the US Chamber of Commerce and has been accredited with the International Association of Professional Debt Arbitrators. This refundable tax credit is for families with qualifying children.

1 2021 and it can be used for any kind of student debt whether federal or. Participants in the program who earn less than 55000 annually receive benefits covering 100 percent of their qualifying law school. Your First Step to Financial Freedom.

Patty Murray lauded the relief and said it should be provided to every other borrower. If you are a former Virginia College student you may not even have to pay back your student loan here are some options you have. Debt management programs in Virginia work with lenders to reduce the interest rate on credit card debt to somewhere around 8 and arrive at an affordable monthly payment that eliminates debt in 3-5 years.

Ad Apply for Income-Based Student Loan Forgiveness if You Make Between 30k - 200k Per Year. See this guide to Federal taxes and student loan forgiveness. Use your refund for some much needed debt relief.

See Guidelines for the Education Improvement Scholarships Tax Credit Program Effective February 7 2020-This is a Word. Talk to a certified debt specialist. Tips to tackle debt in Virginia.

Virginia debt relief programs. Credit Card Debt Consolidation is a Growing Need for Virginians in 2022. If the child is under the age of 6 the parent can potentially receive up to a 3600 credit.

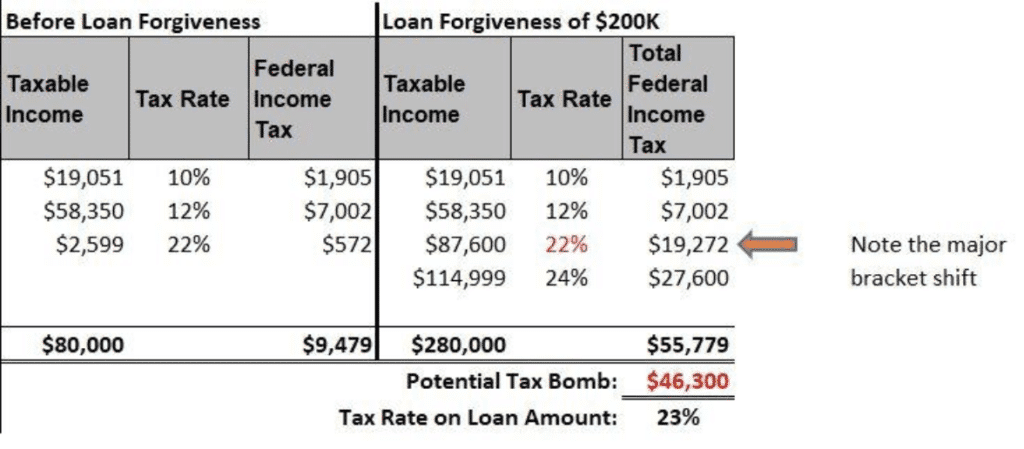

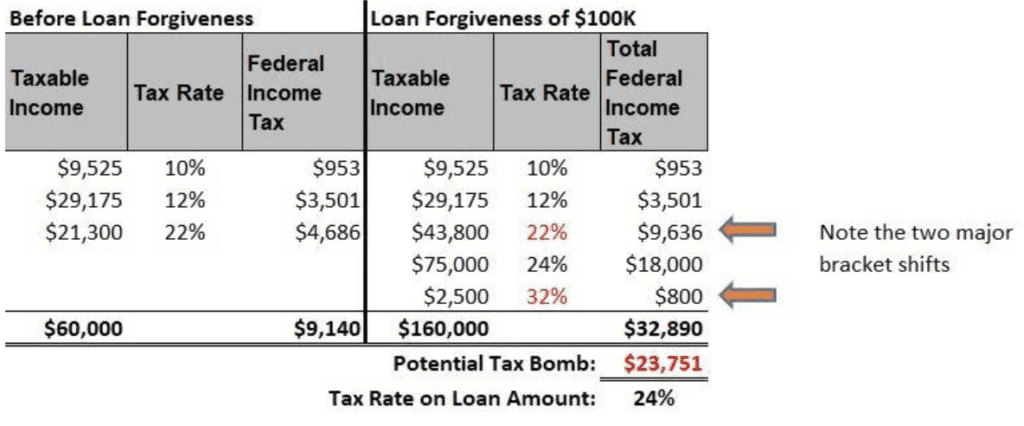

Payday lending laws in Virginia. Ralph Northam announced on Wednesday the payment relief is part of a new initiative by Virginia and several other states to work with major private student loan servicers to. While student loan forgiveness is tax-free federally through December 31 2025 it may not be tax-free on the state-level.

Filing for bankruptcy in Virginia. About the Company Tax Relief Lawyers In Fairfax Virginia. As of March 2022 the average interest rate on credit cards is 167 but if you miss a payment the rate can jump to 20-25.

Of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan debt and provide proof of payment to MHEC. Student Loan Debt Relief. Posted by 5 minutes ago.

In Virginia the average cardholders credit card debt as of 2022 was 7442. The key concern is the reliance on credit cards is increasing while inflation and other economic. She also called for Biden to extend the.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans from an accredited college or university. Information related to the requirements referenced in 581-43928D of the Code of Virginia. Pay off your credit card balance.

Student Loan Debt Relief. Heres how debt in Virginia stacks up against debt across the rest of the country and how it has changed over time. PAY DOWN YOUR DEBT.

This benefit is in effect until Jan. In addition to the subtractions listed below Virginia law also provides several deductions that may reduce your tax liability. And if the child is between 6 and.

Federal Student Loan Forgiveness Programs are Available under the 2010 William D Ford Act. In this scenario the student would be making monthly payments of 200 to pay off their loans in time. Under legislation enacted by the General Assembly Virginias date of conformity to the federal tax code will advance to December 31 2021.

A tax refund provides the opportunity to improve your financial situation. For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who earn less than 75000 annually in public service positions. CuraDebt is a debt relief company from Hollywood Florida.

It was founded in 2000 and has been a participant in the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators. The student loan debt crisis is growing and only getting worse. Make 7200 during an internship to pay down your CURRENT student loan OR.

5980 in compound interest will incur during the 10 year period making the ultimate total paid. Debt resolution is a debt relief option that has become increasingly popular among people who need relief from high-balance credit cards typically 20000 to 125000 or more. The federal government offered temporary tax relief for employers contributing up to 5350 toward their employees student loan payments.

If you have an outstanding balance on more than one credit card try to pay off the. Failure to do so will result in recapture of the tax credit back to the State. Student Achievement Test Result for School Year 2017-2018 and 2018-2019-This is a.

Through debt resolution debt specialists negotiate with creditors on your behalf with the goal of resolving your credit card debt for substantially less than you. Student Loans - external link. In fact prior to the American Rescue Plan Act of 2021 some student loan forgiveness programs were taxable on the federal level.

Only make 5900 after taxes from the same internship. About the Company Virginia Student Loan Debt Relief Tax Credit.

New Options For Student Loan Forgiveness

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Student Loan Forgiveness Programs The Complete List 2022 Update

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

Learn How The Student Loan Interest Deduction Works

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Biden Administration Resists Democrats Pleas On Student Debt Relief As Deadline Nears Virginia Mercury

The Full List Of Student Loan Forgiveness Programs By State

What Are The Income Limits For Student Loan Forgiveness As Usa

Student Loan Forgiveness Programs The Complete List 2022 Update

Biden Seems Closer Than Ever To Deciding On Student Loan Forgiveness And Republicans Are Worried It Might Actually Happen

Student Loan Forgiveness New Study Shows Who Benefits Most Money

Who Owes The Most Student Loan Debt

Virginia Ag Miyares Secures Student Debt Relief From Defunct For Profit College Wavy Com

Student Loans May Qualify For Federal Forgiveness

Biden Has Forgiven 9 5 Billion In Student Loan Debt Money

Virginia College Loan Forgiveness Options Debt Strategists

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner